Lord Alexander Chung-Sik Finkle-McGraw is the fictional adopted Iowa boy-turned-nobleman in Neal Stephenson’s The Diamond Age. While a youth studying engineering at Iowa State University (this author’s alma mater), he witnessed first-hand the decency of his flyover country neighbors in response to a devastating flood. Observing how this event contrasted with the looting and social unrest that plagued other parts of the country, (like the L.A. riots), he concluded that some cultures were in fact superior to others. This perspective, provocative in today’s terms, shaped his embrace of neo-Victorianism – a fusion of traditional values, a hierarchical social structure, impeccable tailoring, and hyper-cool technology. Both an innovator and conservative, Finkle-McGraw elevated the traditionally less noble field of engineering to the status of gentlemanly pursuit in the building up of The Diamond Age, a world where authenticity and craftsmanship become the new currencies in a post-scarcity society.

In our own days of investing nihilism (and actual nihilism), I propose to you the gentleman speculator. He is a hero for guys stuck in fake jobs, liberal arts majors with no job at all, index investors turning off their brains, and gamers trading digital blips on a screen. Similarly to how Lord Finkle-McGraw elevated engineering, we might attempt to restore some nobility to financial investment, not as a mere means of personal enrichment, but as a tool to thrive in an era where pragmatic elites dominate finance and finance pulls the strings.

By engaging in capital deployment purposefully, a gentleman aims to contribute, even if it be in a small way, to the defense of civilized peoples.

The gentleman speculator is duty bound. He is astute, hardboiled, discriminating, patient, long-term oriented, but acts decisively when the time is right. While financial nerds are confined in silos, spreadsheets, and pure quantitative analysis, our hero is multidisciplinary, well-read, performs deep fundamental research, and thinks independently. Likewise, a gentleman speculator is in the real world, sleuthing, gum-shoeing, an active observer, making qualitative observations not found on reddit, twitter, or in Fed tea leaves watching.

I think a lot about how we are to act in a time of post-modern investing angst. Investors, after all, are encouraged to cultivate a lack of curiosity, to blindly throw money at the market, and/or just let Blackrock handle it. But I suspect there are some who have earned the right to trust their own good judgment. They know that Modern Portfolio Theory is not sacrosanct, or that people, companies, and products cannot be minimized to a Morningstar style box. Just as some cultures are objectively greater than others, some men are objectively better at judging an investment than a monkey throwing darts.

It is well known that a speculator is often disparaged by the financial media and the Elizabeth Warrens. This is why he owns the moniker. And true enough, a gentleman typically purchases for the purpose of ownership, and not to sell. However, if today’s market participants – whether buyers of common shares or holders of bitcoins – are labeled as speculators, so be it. The reality is that a gentleman speculator acts in probabilities instead of predicting exact outcomes. Unlike those visitors of gambling dens, he eschews fast money. He understands that investment is more art than science, a balance of intuition and analysis. In the aftermath of success, where others flaunt, the intelligent investor reflects on Graham's paradox: that investments and speculations are often only discernible in retrospect.

Our inspiration is Sherlock Holmes, both homebody and adventurer, the discerning Philip Marlowe, the noblesse oblige of Bruce Wayne (who god forbid received an inheritance!), and the aforementioned Finkle-Mcgraw. In the real world, the archetype comes to life in Bill Miller, the generalist practitioner, Michael Saylor, the audacious visionary, and Anthony Deden, ruminating over centuries-old businesses from his Mediterranean yacht. Jim Grant stands as a voice of erudition, even daring to defend the practice of speculation.

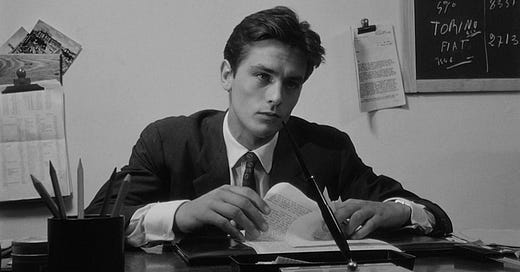

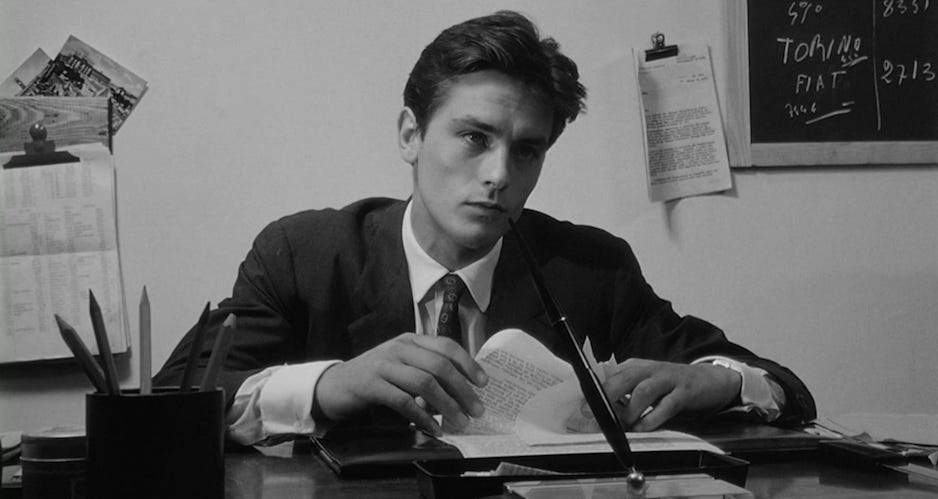

And perhaps, there’s no better visual icon than the late Alain Delon, timeless in a tailored suit.

In our bleak landscape of conformity and short-term thinking, the gentleman speculator stands apart, not just as an investor, but as one who dares to think – to be a man of action – for himself, his family, and community. He embodies a return to tradition, a long-term vision, and a more engaged, resilient approach to wealth and responsibility.

Great article!! We've also been writing on post-modern markets and hyperreality as part of an extended long-form series: e.g., https://bewaterltd.com/p/the-financial-matrix, https://bewaterltd.com/p/the-death-of-the-real. Full series table of contents here: https://bewaterltd.com/p/table-of-contents